31+ How much can i borrow home loan

They typically request at least 5 deposit based on the value of the property. Loans with terms this short can be difficult to repay and often trap borrowers in a cycle of debt.

31 Secret Tips How To Sell Anything To Anyone Things To Sell Marketing Tips Marketing Articles

When you purchase or refinance an eligible home loan.

. Loan amount is between 250000 and under 1 million Maximum LVR 80. Can I borrow even with low net take home pay. How much extra can I borrow.

Closing costs can run 2 to 5 of the loan so a 100000 home equity loan could cost you as much as 5000. An AIP is a personalised indication of how much you could borrow. August 31 202210-Year HELOC Rates Reach.

Mortgage Affordability How to Qualify for a Home Loan. You can also input your spouses income if you intend to obtain a joint application for the mortgage. Policy loans are borrowed against the death benefit and the insurance company uses the policy as collateral for the loan.

Using up your equity could keep you in debt longer and youll be committing to making payments over many years. For references this table will help in determining how much housing loan can a Member avail if heshe pays a certain amount of contribution. If a plan provides for loans the plan may limit the amount that can be taken as a loan.

Home equity loans HELOCs and secured personal loans may all be used to fund your business. Use How Much Can I Borrow calculator to know your borrowing capacity to pay for your mortgage personal or home loan based on your income expenditure. Lenders generally prefer borrowers that offer a significant deposit.

January 31 2020 at 1018 pm. How much can I borrow calculator. Most lenders want collateral thats worth at least as much as the loan you hope to secure.

For example if a participant has an account balance of 40000 the maximum amount that he or she. The availability of the loan package for over P3M to P6M shall be limited by the Funds annual funding allocation for the said package. THINK CAREFULLY BEFORE SECURING OTHER DEBTS AGAINST YOUR HOME.

If she can find a loan with an interest rate of 3 pa. The total interest she will end up paying over the. You can use the above calculator to estimate how much you can borrow based on your salary.

The most common term for a mortgage is 30 years or 360 months but different terms are available depending on the type of home loan that works best for your situation. A cash-out refinance typically has lower interest rates than a HELOC or home equity loan. You can edit your loan term in months in the affordability calculators advanced options.

The length by which you agree to pay back the home loan. 2 The following loan programs are not eligible for the closing cost credit. The amount you can borrow depends on the type of loan you seek your year in school and the cost of attendance.

How Much Can You Borrow Against Your Homes Equity. Family finance home ownership and loans. Maximum additional loan term is 25 years if any element of your mortgage is on interest only.

Personal assets can be used. The Balance Assist loan is even competitive compared to other low-cost payday loan alternatives. You can only borrow against a permanent or whole life insurance policy.

Stamp Duty break was announced in July 2020 and due to end on March 31 2021. On a 30-year loan term her monthly principal and interest repayments will be 2951. The Loan-To-Appraisal Value Ratio.

It will not impact your credit score and takes less than 10 minutes. In this example the lender would be willing to offer a loan amount of 171000. If a house is valued at 180000 a lender would expect a 9000 deposit.

Many federal credit unions offer payday alternative loans where customers can borrow between 200 and 1000 at rates usually around 28 APR. Home equity loans do have drawbacks however. Home Loan repayments calculator.

Exclusions and TCs Apply. The maximum amount that the plan can permit as a loan is 1 the greater of 10000 or 50 of your vested account balance or 2 50000 whichever is less. Offer valid on home purchase applications submitted from January 1 2022 through December 31 2022 where the loans interest rate is locked by December 31 2022.

YOUR HOME MAY BE REPOSSESSED IF YOU DO NOT KEEP UP REPAYMENTS ON YOUR. So if youre looking to borrow 50000 for your business the assets to secure it must have a cash value of at least 50000. Federal VA FHA Rural Development WHEDA Investment Property and Construction loans.

Buy now or save more calculator. FEATURED A NEW CASHBACK OFFER. He has a bachelors from Ohio.

How Much Can You Afford to Borrow. PAG-IBIG SALARY LOAN - Here is a guide on how much you can borrow under the Pag-IBIG Fund salary loan offer based on members contribution. If youre already a mortgage customer and you want to switch your deal please login to manage your mortgage to see what we can offer you.

Subtract the amount remaining on your mortgage 200000 and youll get the approximate sum you can borrow as a home equity loan in this case 97500. Remember that lenders will still impose a maximum amount you can borrow often 80 percent or 85 percent of your available equity so a new loan or a refinance makes the most sense if the value.

![]()

Refinance Student Loans 15 Minutes 3 Simple Steps

Prosper 424b3 20160630 Htm

Should You Invest In Route Mobile Ipo Quora

Pontifications Boeing S Right Direction But Don T Get Ahead Of Reality Leeham News And Analysis

The Measure Of A Plan

201 Catchy Mortgage Company Slogans And Taglines Business Growth Strategies Growth Strategy Business Growth

Pin On Savings Side Gigs Financial Success

Free 31 Credit Application Forms In Pdf

201 Catchy Mortgage Company Slogans And Taglines Business Growth Strategies Growth Strategy Business Growth

Img011 Jpg

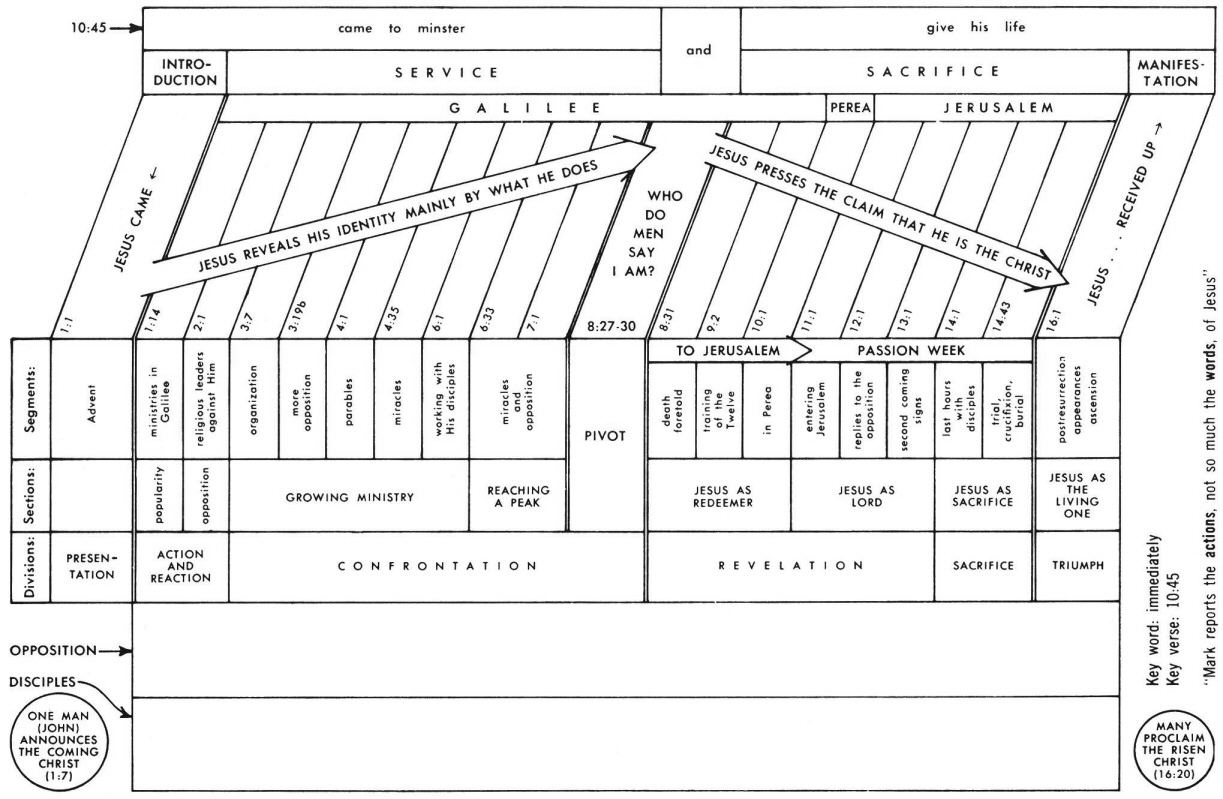

Mark 6 Commentary Precept Austin

![]()

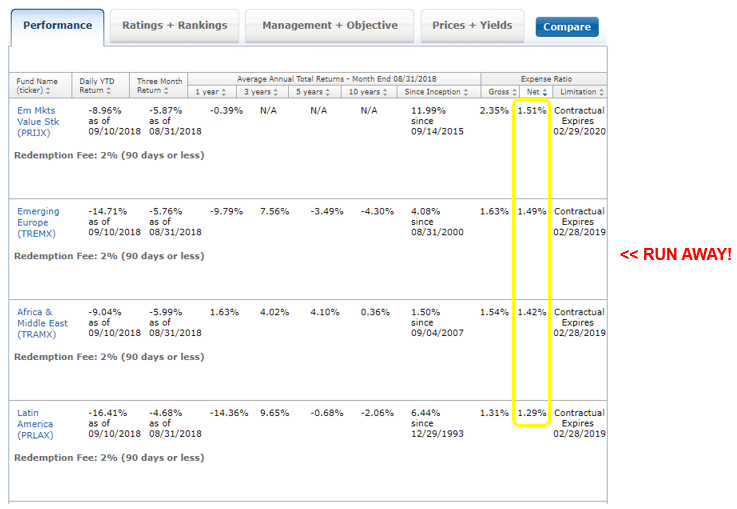

The Measure Of A Plan

Pin On Bible Study

Marlin Business Services Corp 2019 Annual Report 10 K

Img004 Jpg

![]()

The Measure Of A Plan

Pontifications Boeing S Right Direction But Don T Get Ahead Of Reality Leeham News And Analysis

Komentar

Posting Komentar